HQ Team

October 1, 2024: The Abu Dhabi National Oil Company, ADNOC, the state-owned oil company of the United Arab Emirates, will buy Germany’s chemicals maker Covestro AG for 11.7 billion euros ($13 billion).

In one of the biggest acquisitions of a European firm by a Middle East company, ADNOC will pay 62 euros a share, according to a joint statement.

ADNOC International Germany Holding AG, a subsidiary of ADNOC, will subscribe to new Covestro shares at the offer price through a capital increase.

“At an offer price of €62.00, this will result in €1.17 billion in proceeds, which Covestro will use to foster the further implementation,” of its ‘Sustainable Future’ strategy, according to the statement.

21% premium

The offer price represents a premium of 21% to the closing price on June 23, 2024, the last share price before Covestro announced the beginning of the confirmatory due diligence and the start of concrete negotiations.

The takeover offer will be subject to a minimum acceptance threshold of 50% plus one share of Covestro’s capital.

Covestro said that half of the seats on its supervisory board would continue to be held by labour representatives — a usual practice for German listed companies — and two members of the board’s shareholder representatives would be independent of ADNOC.

“In particular, the agreement contains several obligations on the part of ADNOC International to maintain Covestro’s existing business activities, corporate governance and organizational business structure,” according to a statement from Covestro.

Protect technology, IP

ADNOC has pledged not to sell, close or significantly reduce Covestro’s business activities and to protect its technology and intellectual property.

The German company added its management board would stay in charge of management and strategic direction.

There is also a commitment that two members of the supervisory board on the shareholder representatives’ side will remain independent of ADNOC Group after the takeover offer has been completed.

Covestro’s Board of Management, in its current composition, will continue to be responsible for the operational management and strategic direction of the company.

“With ADNOC International’s support, we will have an even stronger foundation for sustainable growth in highly attractive sectors and can make an even greater contribution to the green transformation,” said Dr Markus Steilemann, CEO of Covestro.

‘Circular economy’

Dr Sultan Ahmed Al Jaber, ADNOC Managing Director and Group CEO, said: “As a global leader and industrial pioneer in chemicals, Covestro brings unmatched expertise in high-tech speciality chemicals and materials, using advanced technologies including AI.

“Our aligned strategies uniquely position us to meet the growing global demand for energy and chemical products, while accelerating the transition to a circular economy.”

Covestro is one of the world’s leading manufacturers of high-quality polymer materials and their components. Covestro revenue stood at 14.4 billion euros in fiscal year 2023.

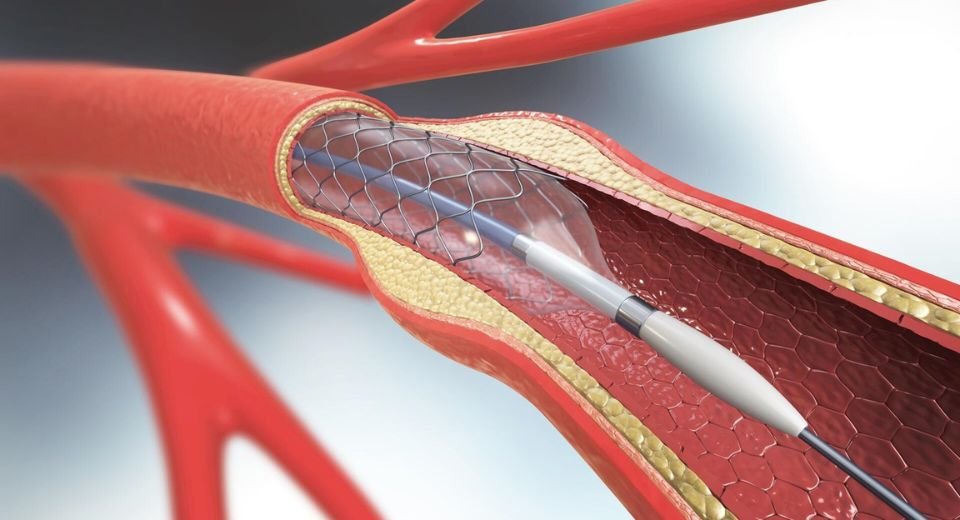

In medicine, Covestro provides high quality plastic materials for drug delivery, surgical instruments, electromedical devices, and wound care.

Polycarbonates

Covestro’s polycarbonates and polyurethanes are robust, transparent, biocompatible, and sterilizable, enabling the development of safe and effective medical products.

Covestro supplies customers around the world in key industries such as mobility, building and living, as well as the electrical and electronics sectors.

In addition, polymers from Covestro are also used in sectors such as sports, leisure and telecommunications.

ADNOC International holds assets and investments across sectors spanning energy, chemicals and low-carbon solutions globally.