HQ Team

July 8, 2024: Antitrust regulators in the UK have cleared a $3.1 billion acquisition of Olink Holding AB by Thermo Fisher Scientific Inc., following an initial probe that began in May last year.

The Competition and Marketing Authority has “investigated and cleared the anticipated acquisition by Thermo Fisher Scientific Inc., of Olink Holding AB and a “full text (will) to be published at a later date,” according to a regulator’s statement.

The regulator considered whether “it is or may be the case that this transaction if carried into effect, will result in the creation of a relevant merger situation under the merger provisions of the Enterprise Act 2002.

“If so whether the creation of that situation may be expected to result in a substantial lessening of competition within any market or markets in the United Kingdom for goods or services,” according to the July 8, 2024 statement.

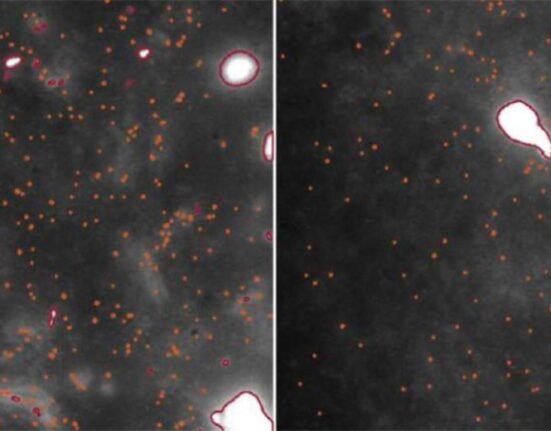

Protein biomarker targets

According to an Olink statement, “As a result of the CMA approval, Olink and Thermo Fisher expect to complete the Offer promptly following the expiration of the Offer at 5:00 p.m. Eastern time on July 9, 2024.”

Olink Holding AB is a provider of solutions for advanced proteomics discovery and development, enabling biopharmaceutical companies and leading academic researchers to gain an understanding of disease at the protein level rapidly and efficiently.

With a library of more than 5,300 validated protein biomarker targets, adoption of the technology has been very strong, leading to over 1,400 scientific publications. Headquartered in Sweden, Olink has operations in the Americas, Europe and Asia Pacific.

In October 2023 its board approved a plan to be bought by Thermo Fisher for $3.1 billion or $26 a share in cash.

Debt financing

It represented a premium of approximately 74% to the closing price of Olink’s American Depositary Shares that traded on NASDAQ on October 16, 2023, the last trading day before the announcement of the transaction.

“Olink’s proven and transformative innovation is highly complementary to our leading mass spectrometry and life sciences platforms. Our company is uniquely positioned to bring this technology to customers enabling them to meaningfully accelerate discovery and scientific breakthroughs,” Marc N. Casper, chairman, president and chief executive officer of Thermo Fisher had said in October 2023.

The transaction was expected to be completed by mid-2024.

Summa Equity AB is Olink’s largest shareholder and additional Olink shareholders and management, in aggregate holding more than 63% of Olink’s common shares.

Thermo Fisher expects to fund the acquisition using cash on hand and debt financing. Upon completion, Olink will become part of Thermo Fisher’s Life Sciences Solutions segment.