HQ Team

October 28, 2024: AbbVie Inc. will acquire Aliada Therapeutics, a biotechnology company focused on developing drugs to treat diseases of the central nervous system such as Alzheimer’s disease, for $1.4 billion in cash.

The transaction is expected to close in the fourth quarter of 2024, according to an AbbVie statement.

Aliada’s therapies use a blood-brain barrier-crossing technology (BBB), and its lead investigational asset utilising this delivery technology is ALIA-1758, which is being developed for the treatment of Alzheimer’s disease.

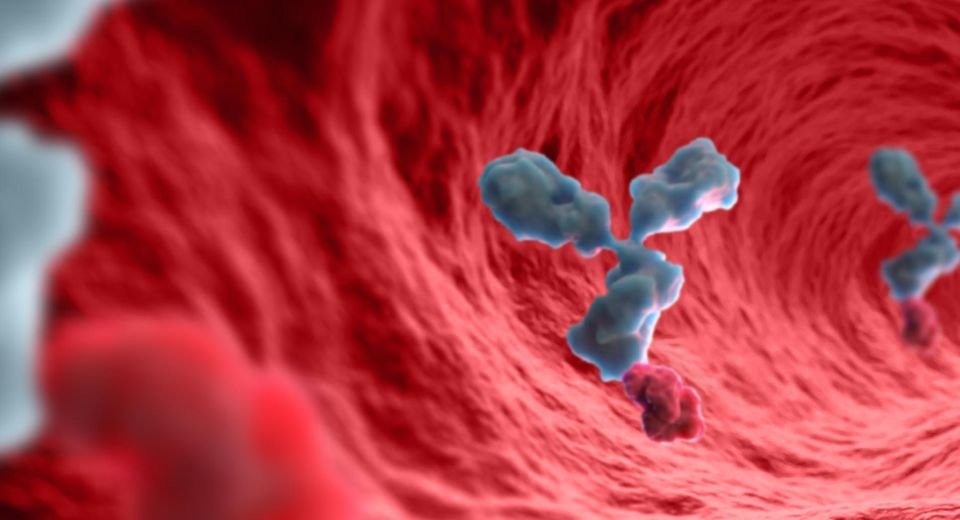

The technology for getting drugs across the blood-brain barrier is crucial for treating brain diseases. ALIA-1758 targets a specific type of amyloid beta protein linked to Alzheimer’s disease. This antibody aims to help treat the disease by effectively crossing the barrier, which normally blocks many medications from entering the brain.

In Alzheimer’s disease, amyloid-beta or Aβ peptides can aggregate to form amyloid plaques, which are characteristic features of the disease.

Neuronal damage, death

These plaques disrupt cell function and contribute to neurotoxicity, leading to cognitive decline. The accumulation of Aβ in the brain is thought to initiate a series of events that ultimately result in neuronal damage and death.

The presence of amyloid plaques can be detected using imaging techniques, and measuring levels of Aβ in cerebrospinal fluid serves as a biomarker for Alzheimer’s disease diagnosis.

Aliada’s ALIA-1758 utilises a protein called transferrin in the blood that carries iron to transport an antibody to degrade and eliminate amyloid beta plaques.

“Neuroscience is one of our key growth areas, and we are committed to driving innovation in this field to address critical unmet needs for patients living with seriously debilitating neurological diseases such as Alzheimer’s disease,” said Roopal Thakkar, MD, executive vice president, research and development and chief scientific officer, AbbVie.

“This acquisition immediately positions us to advance ALIA-1758, a potentially best-in-class disease-modifying therapy for Alzheimer’s disease.

“In addition, Aliada’s novel BBB-crossing technology strengthens our R&D capabilities to accelerate the development of next-generation therapies for neurological disorders and other diseases where enhanced delivery of therapeutics into the central nervous system is beneficial,” he said.

Brain delivery

Aliada’s platform “has enabled the development of ALIA-1758, a promising step forward in brain delivery of an anti-amyloid antibody therapy,” said Michael Ryan, MD, chief medical officer at Aliada Therapeutics.

“Many promising central nervous system-targeted therapies fail to reach late-stage trials due to their inability to cross the blood-brain barrier. Our platform addresses this challenge directly, efficiently delivering targeted drugs and potentially transforming how we treat neurological diseases,” he said.

Aliada is advancing therapeutic candidates using its platform, engineered for high-precision central nervous system drug delivery. It is designed to deliver different types of biological cargo into the brain, including therapeutic antibodies and genetic medicines such as small interfering RNA, according to the statement.

ALIA-1758 enables the degradation and elimination of amyloid beta plaques. This investigational candidate is currently in an early clinical trial to assess its safety and tolerability in healthy participants.

The Aliada platform was created by Johnson & Johnson scientists and was licensed to Aliada at its inception in 2021. J&J’s venture capital arm, Johnson & Johnson Innovation, Raven, RA Capital Management, OrbiMed and Sanofi Ventures have invested in the venture.